Table of Contents

🔍 What is SmartCrowd?

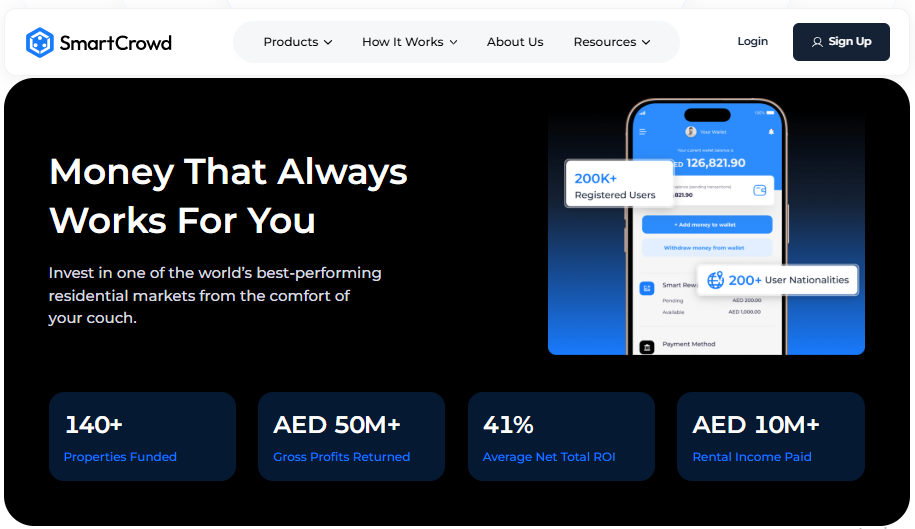

SmartCrowd is the Middle East’s first regulated real estate investment platform that allows everyday investors to co-own high-quality properties in Dubai and the UAE with as little as AED 500. The platform democratizes access to property ownership, enabling passive income and long-term wealth building through fractional real estate.

✨ Launched: 2018

🏠 Headquarters: Dubai International Financial Centre (DIFC)

🔒 Regulated by: Dubai Financial Services Authority (DFSA)

SmartCrowd offers a seamless, transparent, and data-driven way to invest in rental income–generating properties without the burdens of full ownership or large capital requirements.

📈 Why Choose SmartCrowd for Real Estate Investment?

✅ Low Minimum Investment

- Start with as little as AED 500

- Accessible for beginners, students, and young professionals

💼 DFSA-Regulated Platform

- Operates under strict regulatory guidelines

- Full legal compliance and investor protection

📊 Passive Income Through Rental Yields

- Monthly/quarterly rental distributions

- Regular updates on income performance

📅 Diversified Property Portfolio

- Invest across multiple residential & commercial assets

- Minimize risk by diversifying across locations and types

🌐 100% Online Platform

- End-to-end digital process

- Browse, invest, and track performance via desktop or app

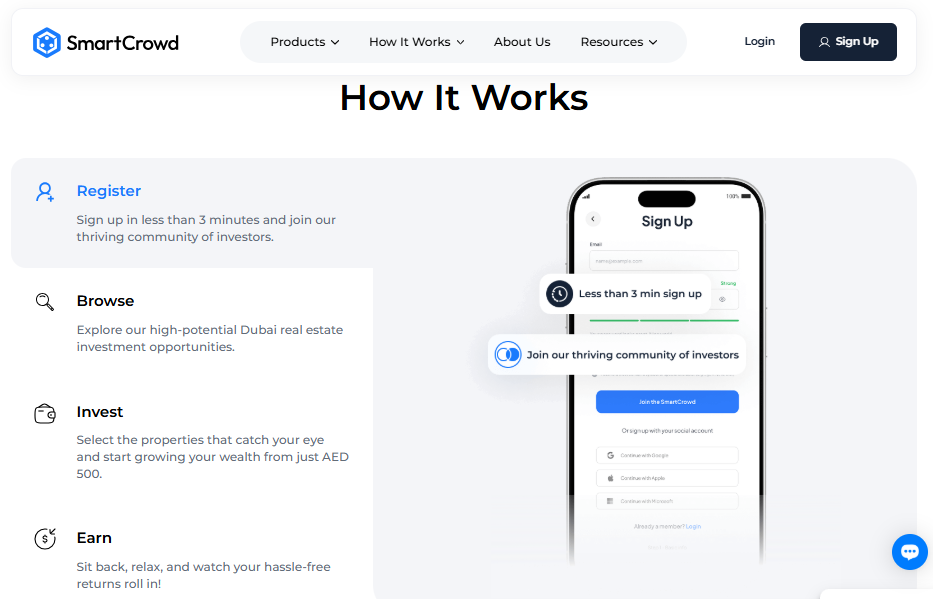

🏡 How Does SmartCrowd Work?

Step 1: Create an Account

- Sign up on the SmartCrowd website or app

- Complete identity verification (KYC)

Step 2: Browse Investment Opportunities

- Explore pre-vetted properties listed with:

- Location, photos, and market data

- Valuation reports and rental yields

- ROI projections

Step 3: Fund Your Wallet

- Transfer funds via bank or payment gateway

- AED 500 minimum to participate

Step 4: Invest in Properties

- Choose your preferred properties

- Select investment amount and confirm ownership

Step 5: Receive Passive Income

- Monthly or quarterly rental income distributions

- Track earnings and portfolio growth via dashboard

📊 Real Estate Crowdfunding Explained

Real estate crowdfunding is the practice of pooling small amounts of money from multiple investors to buy income-generating properties. SmartCrowd operates as a fractional ownership model, where investors co-own a property and share its profits proportionally.

Key Benefits:

- Low entry barrier

- Asset-backed investments

- Professional property management

- Regular rental income + capital appreciation

🌍 Properties Available on SmartCrowd

SmartCrowd focuses primarily on UAE real estate with an emphasis on prime locations and high rental demand. Common listings include:

🏠 Residential

- Downtown Dubai

- Jumeirah Village Circle (JVC)

- Dubai Marina

- Business Bay

🏢 Commercial (coming soon)

- Office spaces in DIFC

- Retail properties

Each listing includes:

- Property photos and floor plans

- Rental history and tenant profiles

- Independent valuation report

- Projected returns and exit strategy

🧼 Who is SmartCrowd For?

| Audience Segment | Why It’s Ideal |

|---|---|

| Beginners | Low capital, no property management |

| Expats in UAE | Own local property without full ownership costs |

| Passive Investors | Regular income, hands-off approach |

| Millennials & Gen Z | Build wealth without large mortgages |

| Diversifying Investors | Real estate exposure alongside stocks/crypto |

🧱 SmartCrowd vs Traditional Real Estate Investment

| Feature | SmartCrowd | Traditional Real Estate |

| Minimum Investment | AED 500 | AED 500,000+ |

| Liquidity | Medium (via resale options) | Low |

| Management | Fully handled | Self-managed or agency |

| Diversification | Easy (multiple properties) | Costly & limited |

| Fees | Platform + management fee | Agent + maintenance + taxes |

🔎 Verdict: SmartCrowd makes real estate investing accessible, simple, and scalable.

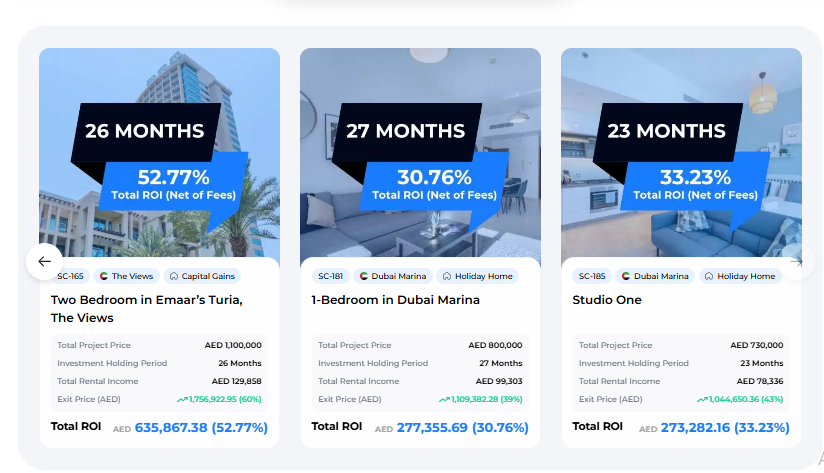

📉 How Much Can You Earn with SmartCrowd?

Earnings depend on:

- Property type and location

- Rental yield (typically 5-8%)

- Holding duration

Example:

Invest AED 5,000 in a JVC apartment yielding 7%:

- Annual income = AED 350 (approx.)

- Capital appreciation potential on resale

🌟 Bonus: Reinvest rental income to compound returns over time.

❌ Risks and Things to Consider

⚠️ Market Volatility

- Property prices can fluctuate

- Rental demand may shift based on economic trends

👥 Platform Risk

- Operational risk if the company fails

- DFSA regulation adds a safety net

💼 Exit Limitations

- Properties have a 5-year target holding period

- Early exits subject to resale marketplace demand

👮 Due Diligence

- Read all documents

- Understand fee structures

- Diversify across 3+ properties to minimize exposure

🚀 Tips for Maximizing Returns on SmartCrowd

- Start small, scale gradually

- Diversify across locations and property types

- Reinvest rental payouts

- Track performance and switch strategies if needed

- Use tax efficiency if you’re investing from a zero-tax country

🌟 SmartCrowd Reviews & Testimonials

“I started with just AED 1,000 and now receive monthly income from 3 properties! Super easy platform to use.” — Farhan, Abu Dhabi

“As an expat, owning a piece of Dubai real estate seemed impossible until SmartCrowd. Best decision I’ve made.” — Lisa, UK

“Great for passive investing. They handle everything from tenant selection to maintenance.” — Mohammed, UAE

🌎 SmartCrowd Global Expansion & Future Outlook

SmartCrowd plans to expand to:

- Saudi Arabia

- Bahrain

- Southeast Asia

They also plan to introduce:

- Commercial property investments

- Secondary resale market

- Blockchain-based property tokenization

📊 SmartCrowd is positioning itself as the go-to platform for accessible real estate investing in emerging markets.

❓ FAQs About SmartCrowd

Is SmartCrowd regulated?

Yes. SmartCrowd is licensed and regulated by the Dubai Financial Services Authority (DFSA).

What are the fees involved?

Typical fees include:

- 1-1.5% upfront sourcing fee

- 10-20% property management and admin fee (yearly)

How long is the investment period?

Usually 5 years. You can exit earlier via the resale feature if there’s demand.

Is SmartCrowd Shariah-compliant?

Yes, selected properties are screened for Shariah-compliance.

Can international investors join?

Yes. Non-residents can invest via SmartCrowd after identity verification.

🎉 Final Thoughts: Is SmartCrowd Worth It in 2025?

SmartCrowd bridges the gap between retail investors and premium real estate. With its low barrier to entry, full regulatory backing, and growing property inventory, it’s one of the most user-friendly and scalable ways to invest in UAE real estate.

It’s ideal for:

- First-time investors

- Expats

- Millennials and Gen Z

- Diversified passive income seekers

🏠 Start building your real estate portfolio today, one fraction at a time.

✨ Bonus: SmartCrowd Sign-Up Promo

🚀 Use code Tumisang-24131 for AED 250 free investment credit on your first property.

Pingback: 💼 How Hostinger Can Become a Great Investment (2025 Guide) - Partner And U-Earn