Table of Contents

🔍 What is Exness Copy Strategy?

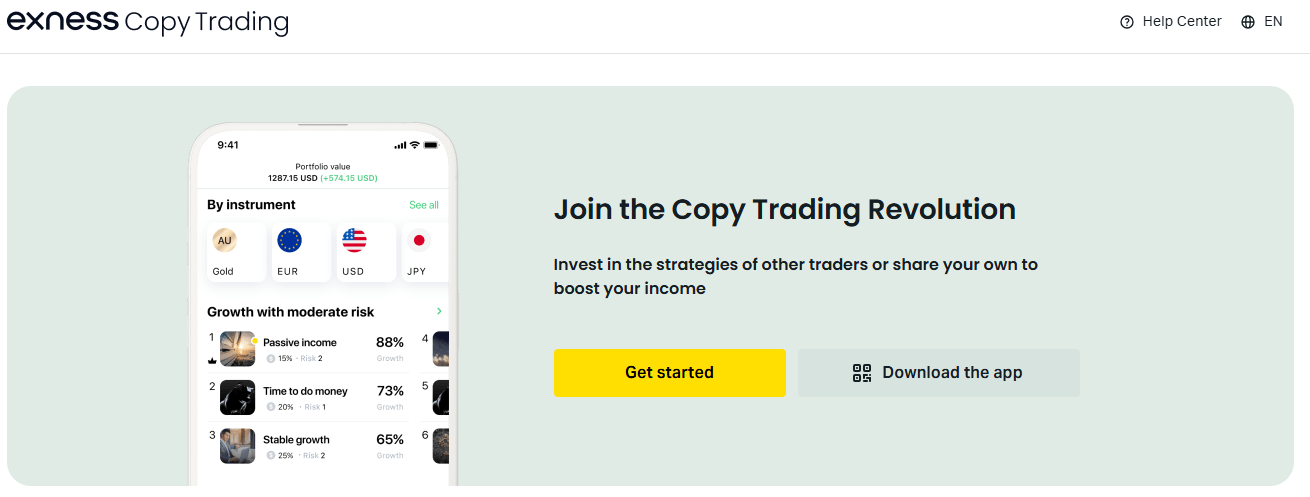

Exness Copy Strategy refers to the process of copying trades from successful traders using the Exness Copy Trading platform. This feature allows beginners and passive investors to mirror the trades of experienced strategy providers in real-time, automatically replicating their performance.

Founded in 2008, Exness is a well-known and regulated broker offering forex and CFD trading, and its copy trading platform is tailored for both beginners and experienced investors seeking passive income through smart trade replication.

🔹 Whether you’re new to trading or looking to diversify your portfolio without active management, the Exness Copy Strategy might be the perfect solution.

📊 Platform Overview

| Feature | Details |

|---|---|

| Broker | Exness |

| Copy Trading App | Exness Social Trading (iOS/Android) |

| Minimum Investment | $10 (strategy-dependent) |

| Fees | Strategy providers set their own performance fees |

| Withdrawal Options | Instant (e-wallets), 1-3 days (banks) |

🔹 Supported Markets: Forex, Crypto, Indices, Commodities

✅ Why Choose Exness Copy Trading?

🌟 Beginner-Friendly

- Zero trading knowledge required

- Simple app interface

- Pre-filtered list of top-performing traders

🧠 Passive Income Potential

- Mirror trades 24/7 without manual input

- Diversify across multiple strategy providers

📈 Real Transparency

- Full access to provider statistics

- View historical ROI, risk level, and number of followers

💸 Low Starting Capital

- Invest as little as $10 to copy a provider

⚠️ Note: Results may vary. Past performance is not indicative of future returns.

🚀 How Exness Copy Strategy Works

1. Sign Up or Log In

Create an Exness account and complete KYC verification.

2. Access the Copy Trading App

Download “Exness Social Trading” on Android or iOS.

3. Browse Strategy Providers

View detailed stats:

- ROI over time

- Risk score (1–10)

- Number of active investors

- Strategy duration

4. Choose & Invest

Select a strategy and enter the amount you’d like to copy with. You can cancel anytime.

5. Track Performance

Monitor copied trades and earnings through the app dashboard.

💼 Pro Tip: Diversify by following 2-3 providers instead of just one.

📊 Best Exness Copy Strategies for 2025

Here are common categories of copy strategies available:

✅ Low-Risk/Stable Growth

- Providers use conservative methods

- Lower drawdown, steady returns

⚔️ High-Risk/High-Reward

- Aggressive trading style

- Higher ROI potential but volatile

💼 Balanced Diversification

- Mix of asset classes (forex + crypto)

- Mid-level risk, stable performance

🌎 Regional or Time-Zone Focused

- Providers trading specific markets (e.g., Asian or London session)

- Great for targeted strategy matching

📱 You can filter strategies by risk score, asset class, or ROI in the app.

❓ Who Should Use Exness Copy Trading?

| User Type | Why It’s a Good Fit |

| Beginners | No need to learn charts or indicators |

| Busy Professionals | Trade without time commitment |

| Passive Investors | Alternative to stocks or crypto holding |

| Diversifying Traders | Use alongside manual trading accounts |

🔹 Copy trading is not just for beginners. Many seasoned traders use it to test new ideas or earn extra profits by becoming providers themselves.

🧐 How to Choose the Right Strategy Provider

1. Review Past ROI

Check at least 3 months of consistent returns. Avoid “too good to be true” stats.

2. Evaluate Risk Score

Look for providers with a score below 6 for more stable results.

3. Analyze Drawdown

Drawdown shows how much the account has declined at its worst. Lower is better.

4. Check Active Days

Choose strategies that have been active for over 90 days.

5. Read Reviews

See what other followers are saying.

⚡ Copy trading isn’t a shortcut to riches – it’s about choosing the right trader to follow and managing risk.

👥 Becoming a Strategy Provider on Exness

Do you already trade profitably? Become a Strategy Provider and earn extra income through performance fees.

Requirements:

- Verified Exness account

- Real trading history

- Low drawdown & consistent performance

Benefits:

- Earn passive income from followers

- Build your reputation

- No additional effort after setting up

🚫 Common Mistakes to Avoid

❌ Chasing Unrealistic ROI

- High % returns often come with huge risk

❌ Copying Too Many Providers

- Stick to 2–3 solid strategies

❌ Not Monitoring Performance

- Regularly check if your strategy is still performing well

❌ Ignoring Risk Metrics

- ROI alone isn’t enough; understand risk before investing

🧼 How Does Exness Compare to Other Copy Trading Platforms?

| Feature | Exness | eToro | ZuluTrade | OctaFX |

| Min. Investment | $10 | $200 | $100 | $25 |

| Performance Fee | Custom | Included | Fixed/Custom | Fixed |

| Strategy Stats Detail | High | Medium | High | Medium |

| Mobile App | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Regulation | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

🔹 Verdict: Exness stands out for its ultra-low minimum investment, customizable fee structure, and a wide variety of strategies.

📖 FAQs About Exness Copy Strategy

❓ Can I stop copying a strategy at any time?

Yes, you can exit a strategy instantly through the app.

❓ Is there a fee to use the Exness Copy platform?

No platform fee, but providers may charge a performance-based fee (set individually).

❓ What happens if the provider loses money?

You will mirror their trades, including losses. That’s why risk evaluation is essential.

❓ Can I copy multiple strategies?

Yes. Diversifying across 2–3 providers is actually recommended.

❓ Is copy trading legal?

Yes. Exness is regulated in multiple jurisdictions and operates legally.

🌟 Final Thoughts: Is Exness Copy Strategy Worth It in 2025?

If you want to trade smart without staring at charts all day, Exness Copy Strategy is one of the best choices in 2025.

With its low entry barrier, variety of proven strategies, mobile-first experience, and transparency, it’s ideal for:

- Beginners

- Busy professionals

- Side-income seekers

- Risk-managed portfolio diversifiers

🎉 Ready to start?

➡️ Join Exness and start copying trades

✅ Stay informed, copy wisely, and grow passively.